Welcome to Stocklord.in, where your journey to smarter trading begins! Tuesdays are the perfect time to refine your strategies, and our Nifty 50 intraday predictions for January 21, 2025, combine advanced trading techniques with the timeless wisdom of astrology. Uncover how planetary movements can influence market trends and gain the insights you need to achieve financial growth. Join us at Stocklord.in, where innovation and accuracy drive your success!

Astrological Events and Prediction on 21st January 2025:

21st January 2025 (Tuesday)

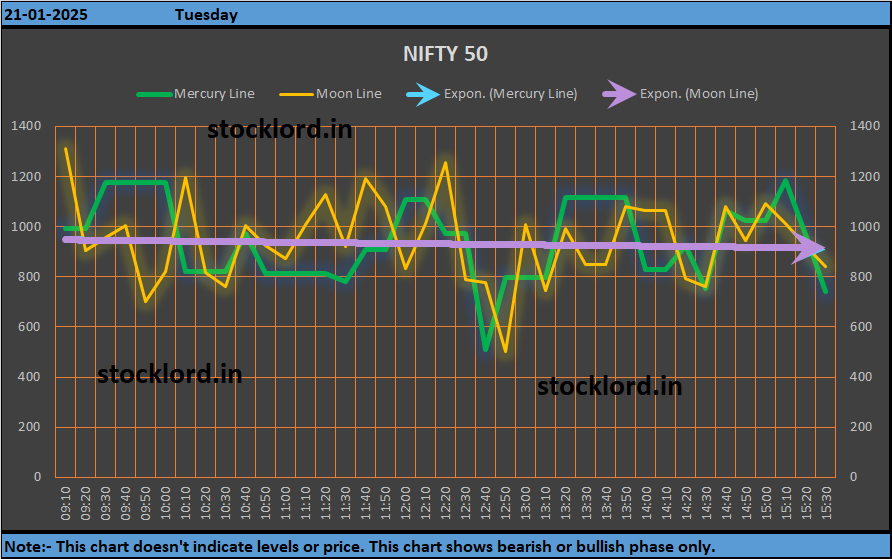

1st Half:

Moon in Virgo, Chitra Nakshatra Pada-2.

Aspected by Venus, Saturn. Mars is transiting in Gemini from Cancer with retrograde motion.

Expected Movement: Bullish

2nd Half:

Moon in Virgo, Chitra Nakshatra Pada-3.

Aspected by Venus, Saturn. Mars will be in Gemini.

Expected Movement: Bullish.

Overall NIFTY 50 Movement

Overall in the market volatility shall be high.

The Prediction Chart of Nifty 50 for the day 21st January 2025

Note: – Mercury Line shows the overall shape of the chart and the Moon Line shows fluctuation or volatility.

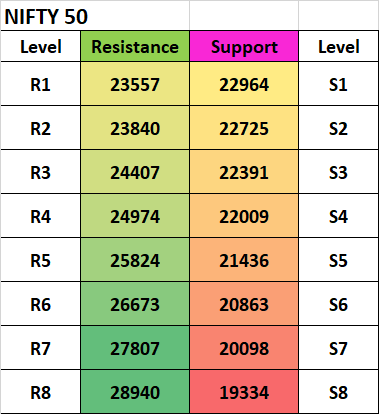

Support and Resistance Level

Major Support and Resistance Level for Nifty 50.

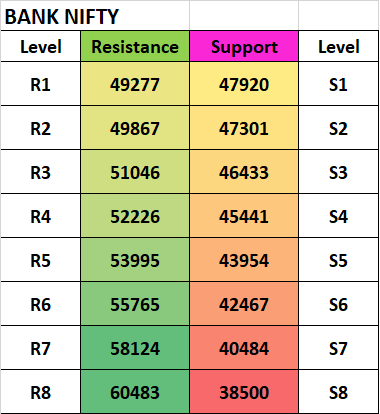

Major Support and Resistance Level for Bank Nifty.

What are Support and Resistance Levels?

A support level is like the floor of a house—it’s the price level where a stock tends to stop falling because many buyers step in to purchase it. Think of it as a safety net that keeps the price from dropping further.

A resistance level is like the ceiling of a house—it’s the price level where a stock tends to stop rising because many sellers start selling it. It’s a barrier that prevents the price from going higher.

In short:

- Support = Price won’t fall easily below this level.

- Resistance = Price won’t rise easily above this level.

These levels are not exact numbers but zones where the stock price often changes direction.

Trading advice combining Technical Indicators with Astrological prediction chart

When trading using our Nifty 50 prediction chart, validating the forecast with reliable technical indicators like a Stochastic Oscillator or RSI (Relative Strength Index) is crucial. For instance, when the prediction chart indicates a potential high in the market, check if the Stochastic or RSI values are above 80, signaling an overbought condition. This alignment strengthens the likelihood of a reversal or a temporary slowdown, offering a prime opportunity to sell, short, or buy a PUT option. Similarly, when the prediction chart shows a downward trend, ensure the Stochastic or RSI is below 20, confirming an oversold condition. This creates a strong buying opportunity, or CALL option aligning technical data with astrological insights for precise entry and exit points in intraday trading. Always combine both for maximum accuracy and minimize risk in your trading strategy. For more details click here.

Before taking any trading decision based on this article or post please go through the Disclaimer page.